Register

to get articles and more to your inbox

News & insights

Archive

Directory

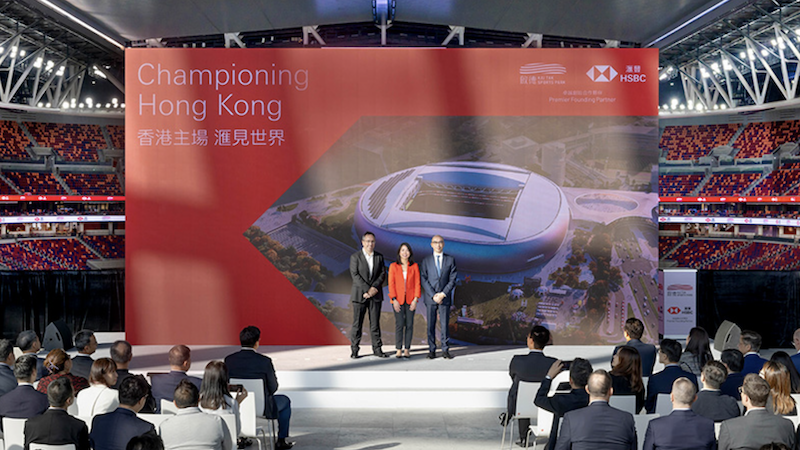

HSBC Secures HK’s Kai Tak Sports Park Partnership

The Hong Kong and Shanghai Banking Corporation (HSBC) has sealed a deal to become the exclusive Premier Founding Partner of the new Kai Tak Sports Park in Hong Kong.

The stadium slated to officially open early next month ahead of the Rugby Sevens leg in Hong Kong, will see HSBC back it as part of the bank’s ‘Championing Hong Kong’ Partnership Programme, which aims to promote community sports development to nurture a healthier Hongkongers.

Following the partnership with HSBC, John Sharkey, project director of Kai Tak Sports Park Limited, stated, “By leveraging Kai Tak Sports Park’s world-class multipurpose facilities we will have international sports and entertainment events. This collaboration aims to develop a platform that boosts the City’s reputation and economic activity in this sector transforming Hong Kong into an Event Capital by injecting continuous new momentum into our local economy.”

The Football Association of Hong Kong has revealed that several promoters are keen in bringing the likes of Tottenham Hotspur, Manchester United and FC Barcelona for their pre-season tours to the soon-to-be-opened stadium.

Luanne Lim, CEO of HSBC Hong Kong, enthused, “I am proud that we are able to support such an incredible landmark. The KTSP not only reflects Hong Kong’s success on the global stage but also serves as a vibrant hub for our community. I look forward to welcoming our international clients to the Cathay/HSBC Hong Kong Sevens at the 50,000-capacity Kai Tak Stadium in March. This partnership also aligns with our upcoming celebration of 160 years in Hong Kong. We are excited to partner with the KTSP to enhance Hong Kong’s presence in international sports and entertainment.”

According to ASN data, HSBC (21.7%, US$59.2m+) is the 2nd largest spender for its category in the Asian sponsorship market since Q222, with an average quarterly investment of US$5.5m+ during this period. As for Q125, it is forecasted to hit almost US$7.9m, an increase of slightly over 42% of the average quarterly investment. The three biggest markets for the financial institution continues to be Singapore (29.9%), Hong Kong (29.4%) and China (24.7%).